It is unlikely from the content of this page, but I am a fixed-income financial nerd by profession. Last year, as the housing market began to unwind, and the financial crisis set it, an often mentioned topic was that of record US Household Debt. A key component of the creation of the housing bubble that burst so dramatically, was an equally large bubble in credit. The reckless practices by banks and lending institutions, coupled with high consumer confidence and rising housing prices, led to the US personal savings rate dipping into negative territory.

I couldn't help but draw the connection between careless spending, and a broader carelessness in America. In a world dominated by Lipitor, fad diets, ever-changing nutritional standards, aggressive food marketing, Americans have expanded almost as fast as the housing market. Just like Countrywide giving $800,000 loans to unemployed janitors, using the rational of ever-rising home prices, the big food companies do their best to convince us that Froot Loops and Frosted Flakes are "smart choices."

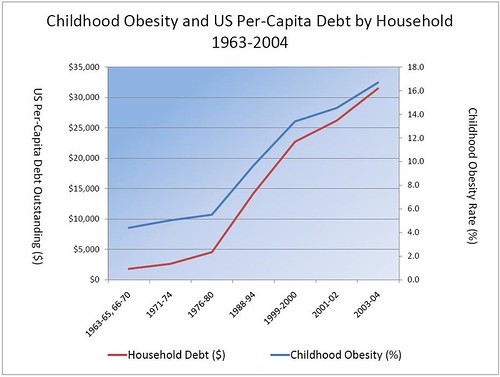

Based on childhood obesity data from the CDC and the Federal Reserves US Household Debt data, I decided to put the two together. The relationship is staggering. The actual correlation of the two data sets is .998, almost perfect.

We all know how the housing market story ended. Where this leads, with respect to our national health and the safety of our food supply, is yet to be determined. What has been determined, sadly, is a pattern of behavior that plagues us in America: why deal with the problem today, if I can put it off until tomorrow?

Tomorrow is getting closer.

Tomorrow is getting closer.

Interesting. For a while now I've speculated about a different correlation between the financial crisis and our food system. Just as our financial institutions got deeper and deeper into the business of producing profitable 'junk' (with government complicity), our food companies are doing the same (with government subsidies). Short term profit rules the day. What kind of crisis in the food system will it take to reverse this trend? Major food safety crisis? Empty supermarket shelves? How many people have to suffer (or die) before we realize that we have to reverse course?

ReplyDeleteWe can't seem to gather the political will to do something meaningful about healthcare. Will there be corresponding crazies out there that will shout about government panels that will deny us our Twinkies?

I'd like to think that if enough of us vote with our food dollars it will make a difference, but I may be too old for such optimism (i.e. innocence). I'm afraid it will take real pain, enough pain to demonstrate that significant reform is the only way to avoid a demise which is already well underway.

The financial system nearly collapsed and our reaction was to feed dollars into the system to keep it from stalling altogether. Add a few touches of cosmetic regulatory reform, and we're back on the same track.

Is food any different?

LarryL